Red Sea attacks have DOUBLED the average cost of container shipping

01/24/2024 / By Richard Brown

The global shipping industry is grappling with a significant upheaval as the average cost of containers has surged to more than double its previous rate within just one month.

The primary driver behind this unprecedented increase is the ongoing disruption caused by Houthi attacks on cargo vessels navigating the Red Sea. These attacks, stemming from the Israel-Hamas conflict that began in October, have sent shockwaves throughout global supply chains, resulting in delayed shipments and a substantial escalation in transportation costs.

Data provided by London-based Drewry Shipping Consultants highlights the staggering impact on container shipping costs.

In the week ending January 18, the average worldwide cost of shipping a 40-foot container experienced a remarkable 23 percent spike, reaching a staggering $3,777. (Related: Oil prices could double as Red Sea attacks continue, experts warn.)

This surge underscores the acute challenges faced by the shipping industry, far beyond the specific trade routes connecting China with Europe and the U.S. East Coast.

The repercussions of these disruptions are extensive, as evidenced by a 38 percent increase in spot rates for shipping a container from China to Los Angeles during the same week, reaching an elevated rate of $3,860.

As the industry contends with this sudden and pronounced volatility, major companies with long-term contracts are compelled to absorb surcharges exceeding 20 percent on their contract rates. These surcharges are implemented to offset the rising costs associated with crucial elements such as fuel and insurance.

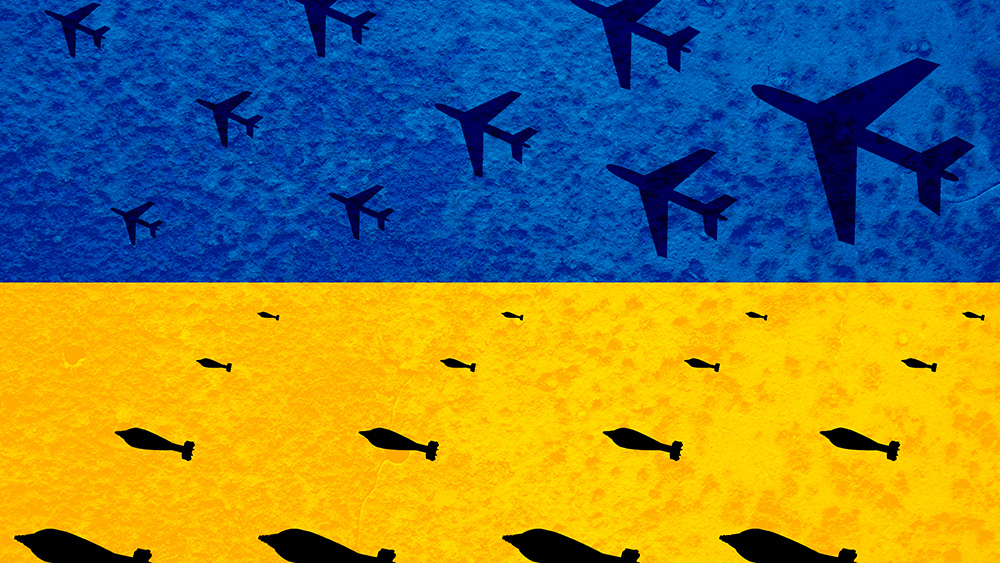

The root cause of these disruptions lies in the relentless Houthi attacks on cargo vessels operating in the Red Sea. The militant group based in Yemen has executed numerous drone and missile strikes, creating an environment of heightened risk of maritime traffic in the region.

Threats forcing cargo ships to take longer routes

The increased threat has prompted major shipping firms to divert from the Suez Canal, historically the quickest route for transporting cargo between Asia and Europe. The Suez Canal, a vital waterway accounting for 15 percent of global commercial shipping, has experienced a stark decline in maritime traffic.

Comparing 2024 figures to the previous year, traffic through the canal has decreased by 37 percent, as major shipping companies opt for alternative routes to mitigate the risks associated with the Red Sea.

The carriers have been forced to suspend plans to restart transits through this key artery, causing disruptions and increasing transportation costs in global supply chains.

The ongoing attacks by Yemen-based Houthi militants on high-value cargo vessels since November have prompted ships to reroute around the southern tip of Africa, contributing to higher costs for vessels due to the extended voyage.

The Red Sea connects to the Mediterranean Sea through Egypt’s Suez Canal, serving as a vital trade route for shipping fuel, food and consumer goods from Asia and the Middle East to Europe. This route is crucial for ferrying about one-third of all global container cargo, including items like toys, shoes, furniture and frozen food.

The attacks have already led to delays in the delivery of products for various companies, including major players like IKEA, Walmart and Amazon.

As the disruptions continue, shipping rates are soaring. Asia-to-North Europe rates have more than doubled to surpass $4,000 per 40-foot container, while Asia-to-Mediterranean prices have climbed to $5,175, according to data from Freightos, a booking and payments platform for international freight.

Some carriers are announcing rates exceeding $6,000 per 40-foot container for Mediterranean shipments starting mid-month.

Additional surcharges ranging from $500 to as much as $2,700 per container could further drive up all-in prices. Hundreds of container ships and other vessels have been rerouted around Africa’s southern Cape of Good Hope to avoid the attacks, tacking on extra voyage time of seven to 20 days.

The so-called “spot” rates for these rerouted shipments are roughly double the rates for freight in the contract market, reflecting the urgency and desperation to secure space on ships.

Watch how the chaos in the Red Sea is impacting international trade.

This video is from the NewsClips channel on Brighteon.com.

More related stories:

Maersk to customers: Brace for complications, disruptions in Red Sea.

Qatar pauses all LNG shipments in Red Sea following U.S. bombing of Houthis.

Major shipping giants HALT Red Sea route following Houthi attacks on shipping vessels.

Sources include:

Submit a correction >>

Tagged Under:

bubble, chaos, Collapse, debt collapse, economic riot, finance riot, Houthis, inflation, insanity, Israel, market crash, money supply, Red Sea, risk, shipping, supply chain, terrorism, threats, violence, World War III

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 VIOLENCE NEWS